Property Mortgage Guidance: Make Informed Decisions

Buying property is one of the most significant financial decisions a person can make. For many individuals, taking a mortgage becomes a…

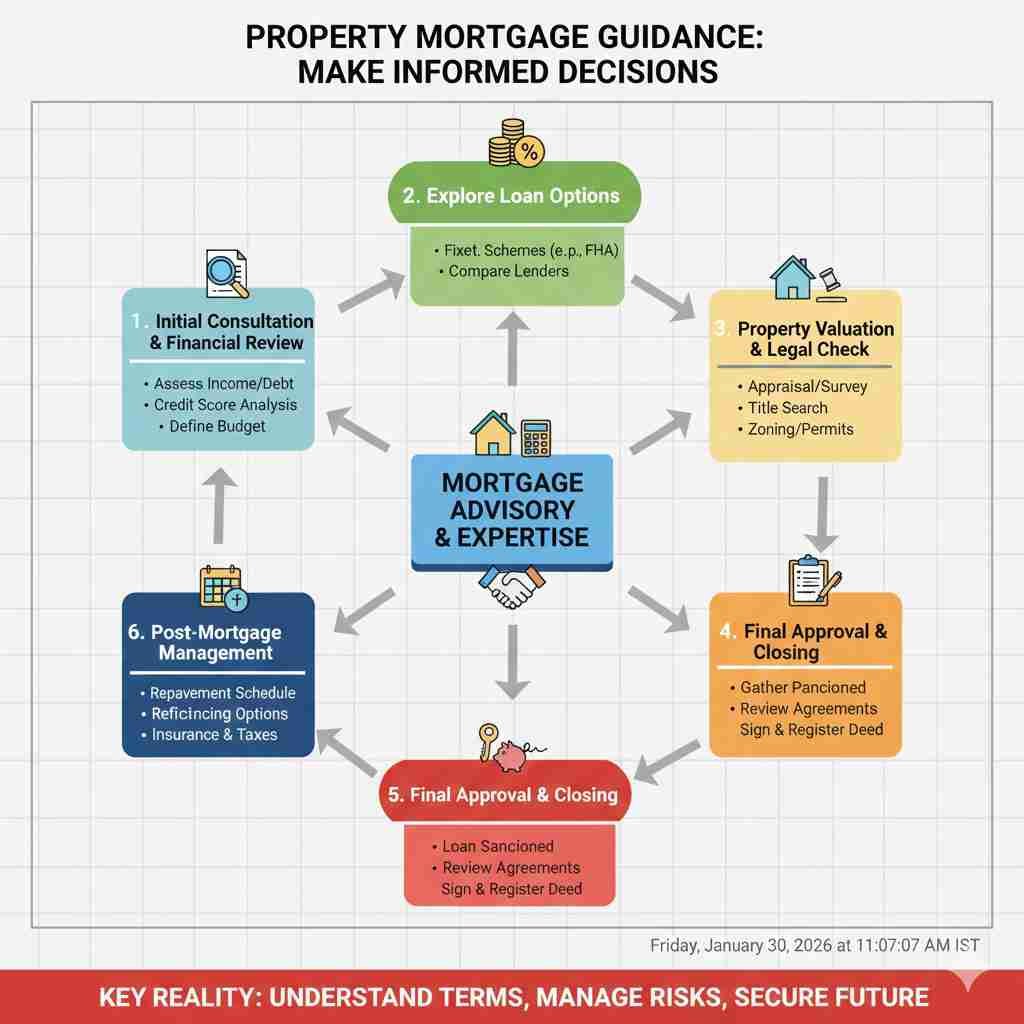

Buying property is one of the most significant financial decisions a person can make. For many individuals, taking a mortgage becomes a necessary step to achieve this goal. However, a mortgage is not just a financial transaction; it is a long-term commitment with legal and financial implications. Making informed decisions is crucial to avoid future disputes, excessive debt, or even property loss. At Paramount Law House: Property Lawyers 24×7, we guide clients through every step of property mortgages, ensuring that decisions are well-informed, legally sound, and aligned with financial goals. This article provides practical guidance for individuals, families, and investors considering property financing.

Property Mortgage Guidance: Make Informed Decisions – Paramount Law House

Understanding Property Mortgages

A property mortgage is essentially a loan taken against real estate. The property acts as collateral, which means the lender has the right to take possession if the borrower defaults. Mortgages typically involve interest rates, repayment schedules, and various legal requirements.

Understanding these elements is the first step toward making sound financial decisions. A mortgage is not just about borrowing money; it is about balancing financial capacity, legal obligations, and future planning.

Types of Property Mortgages

Different types of property mortgages exist, each with unique features. Understanding them helps borrowers choose the right option:

1. Fixed-Rate Mortgages

In this type, the interest rate remains constant throughout the loan period. This provides predictability in monthly payments and helps in long-term financial planning.

2. Floating-Rate Mortgages

Here, the interest rate varies based on market conditions. While initial rates may be lower, payments can increase over time, depending on economic factors.

3. Reverse Mortgages

Typically for senior citizens, reverse mortgages allow homeowners to receive regular payments against the value of their property, without selling it.

4. Interest-Only Mortgages

Borrowers pay only the interest for a set period, which reduces initial payments but increases future financial obligations.

Each type has advantages and disadvantages, making expert guidance essential.

Legal Considerations in Property Mortgages

A mortgage is not merely a financial agreement; it is a legal contract. Ignoring legal aspects can lead to serious problems. Key considerations include:

- Title Verification: Ensuring that the property has a clear title and is free from disputes.

- Mortgage Documentation: Drafting and reviewing loan agreements carefully to protect borrower rights.

- Registration: Registering the mortgage deed as required by law to make it legally enforceable.

- Encumbrance Check: Confirming that the property is free from prior claims or liens.

- Compliance with Regulations: Ensuring that all agreements comply with banking and property laws.

At Paramount Law House, we carefully examine each document, protecting our clients from legal risks.

Financial Assessment Before Taking a Mortgage

Before committing to a mortgage, a borrower must conduct a thorough financial assessment. This includes:

- Income Analysis: Ensuring sufficient and stable income to cover monthly payments.

- Debt-to-Income Ratio: Evaluating existing debts to determine borrowing capacity.

- Emergency Planning: Reserving funds for unforeseen events that may affect repayment.

- Interest and Fees Understanding: Assessing how interest rates, processing fees, and other charges affect total repayment.

By understanding financial realities, borrowers can avoid default and long-term financial stress.

Role of Property Lawyers in Mortgage Decisions

Property lawyers play a critical role in mortgage transactions. They provide guidance, risk assessment, and legal security. Key roles include:

- Document Review: Ensuring loan and property documents are accurate and enforceable.

- Title Verification: Confirming the property is legally owned and free of disputes.

- Negotiation Support: Advising on terms, interest rates, and clauses to protect clients’ interests.

- Dispute Resolution: Representing clients in disputes with lenders or third parties.

Legal support ensures that mortgages are not just financially viable but also legally secure.

Common Mistakes to Avoid

Many borrowers make avoidable mistakes when taking a mortgage. Awareness helps prevent long-term problems. Common mistakes include:

- Ignoring legal verification of the property title.

- Focusing only on low-interest rates without evaluating total repayment.

- Overlooking additional charges like processing fees, prepayment penalties, or insurance requirements.

- Failing to maintain proper documentation of loan transactions.

- Underestimating the impact of fluctuating interest rates in floating-rate mortgages.

Avoiding these mistakes requires a combination of legal and financial guidance.

Understanding Mortgage Repayment Options

Mortgage repayment can be structured in different ways. Borrowers should carefully choose a plan that aligns with their income and financial goals:

- Equated Monthly Installments (EMIs): Fixed monthly payments combining principal and interest.

- Step-Up EMIs: Gradually increasing payments, suitable for growing income.

- Bullet Payments: Large repayment at the end of the term, often used for business loans.

A clear understanding of repayment options reduces the risk of default and helps maintain financial stability.

Foreclosure and Its Implications

Foreclosure occurs when a borrower fails to repay the mortgage, and the lender takes possession of the property. This situation can have severe legal and financial consequences.

Preventive measures include:

- Timely repayment of EMIs

- Communication with lenders in case of financial difficulty

- Considering restructuring or refinancing options

- Legal intervention to protect borrower rights

At Paramount Law House, we guide clients to prevent foreclosure and negotiate solutions if financial stress occurs.

Mortgage for NRIs and Overseas Buyers

Non-Resident Indians (NRIs) face additional complexities in property mortgages. Legal guidance is critical for compliance with:

- FEMA (Foreign Exchange Management Act) regulations

- Restrictions on property types and ownership

- Repatriation of funds

- Taxation implications

Expert legal advice ensures that NRIs can invest in property without violating Indian laws or facing complications with mortgage lenders.

Mortgage Disputes and Resolution

Even with careful planning, disputes may arise. Common mortgage disputes include:

- Loan default or delayed payment claims

- Misrepresentation of property ownership

- Hidden encumbrances or prior claims

- Disagreements over terms, interest rates, or fees

Resolution mechanisms include negotiation, mediation, or court intervention. Legal experts provide representation and protect clients’ rights in all scenarios.

Tips for Making Informed Mortgage Decisions

To make informed decisions, consider these practical tips:

- Consult Legal Experts Early: Seek guidance before signing any agreement.

- Understand the Fine Print: Read all terms, including prepayment, foreclosure, and hidden charges.

- Verify Property Ownership: Ensure the property has a clear and unencumbered title.

- Evaluate Financial Capacity: Analyze income, expenses, and future financial plans.

- Monitor Market Conditions: Consider interest trends and lending policies before committing.

- Plan for Emergencies: Maintain an emergency fund to cover missed payments.

- Keep Records: Maintain all documents, receipts, and communications for future reference.

These steps minimize risk and provide long-term security.

Why Choose Paramount Law House: Property Lawyers 24×7

At Paramount Law House, we provide comprehensive guidance for all mortgage-related matters. Our services include:

- 24×7 legal support for property transactions

- Thorough due diligence and title verification

- Expert drafting and review of mortgage agreements

- Negotiation and dispute resolution

- Support for NRIs and cross-border property transactions

Our goal is to ensure that clients make mortgage decisions confidently, with full knowledge of financial and legal implications.

Frequently Asked Questions

A property mortgage is a loan taken against a property as collateral. The borrower receives funds from a lender to purchase or refinance real estate. In return, the borrower agrees to repay the principal with interest over a specified period. If the borrower defaults, the lender has the legal right to take possession of the property.

Before taking a mortgage, it is essential to verify the property title, check for encumbrances, and ensure there are no disputes or prior claims. Mortgage agreements must comply with legal requirements, and registration of the mortgage deed is necessary to make it enforceable. Consulting a property lawyer helps prevent future legal complications and protects borrower rights.

Borrowers should consider financial capacity, repayment flexibility, and risk tolerance. Fixed-rate mortgages offer stable payments, while floating rates may change with market conditions. Reverse mortgages suit senior citizens, and interest-only loans reduce initial payments but increase future obligations. Professional guidance ensures the chosen mortgage aligns with long-term financial goals.

NRIs must comply with FEMA regulations, understand restrictions on property types, and consider repatriation and taxation rules. Legal experts assist in documentation, lender coordination, and ensuring compliance, making cross-border mortgage transactions smooth and legally secure.

Legal experts review agreements, verify ownership, advise on terms, and assist in dispute resolution. They help borrowers avoid hidden charges, late-payment penalties, or foreclosure issues. With expert guidance, borrowers can make informed decisions, reduce risk, and secure their property investment effectively.

Conclusion: Secure Your Property, Protect Your Future

In conclusion, a property mortgage is more than a financial transaction; it is a long-term legal and financial commitment. Making informed decisions requires awareness of financial capacity, legal obligations, and potential risks.

By seeking expert guidance from Paramount Law House: Property Lawyers 24×7, individuals, families, and investors can navigate the complex mortgage process with confidence. Proper planning, legal verification, and professional support ensure that your investment in property remains secure and beneficial for years to come.

Read More

- Property Partition through Will Probate: Legal Expertise

- Property Registration Assistance: Ensure Compliance and Legality

- Property Sale in Pagdi System: Legal Assistance Available

- Best ODI Filing Consultant in India for Overseas Investment Compliance

- RBI Compliance Consultant Services – Stay Fully Compliant with RBI Rules

- National Portal of India – Government Services